The Friends of the Cromford Canal aim is the restoration, reconstruction, preservation and maintenance of the Cromford Canal; its associated buildings, towing path, structures and craft and the conservation of its natural character as a navigable inland waterway system for the benefit of the public.

The canal passes through many interesting natural and heritage features beginning in Cromford and carrying on down to Langley Mill with a short branch from Codnor Park Reservoir to Pinxton.

The canal is only partially in water with the first 2 miles able to support a trip boat. There are several opportunities from Ambergate down which could be brought back into use/rewatered. Our largest restoration project is to reinstate the canal at Beggarlee just up from Langley Mill. It is this project which will keep us busy for several years to come!

Much of the work of the Friends of the Cromford Canal has been possible because of the legacies left by individuals, with the vast majority of work carried out by our dedicated and hard-working volunteers. Volunteers contribute a significant non-cash contribution using their skills and time well spent.

Legacies are helping us to start projects that otherwise wouldn’t have been possible.

An example of this is the Beggarleee restoration project.

By considering a gift in your Will you can help create a place for future generations – a place for people and wildlife alike to enjoy.

Your legacy can reduce your inheritance tax bill.

A legacy for the Friends of the Cromford Canal will be exempt from Inheritance Tax.

Let’s look at an estate valued at £500,000 after funeral expenses and other liabilities. The tax-free nil-rate band of £325,000 leaves a taxable balance of £175,000, taxed at 40% – £70,000 – meaning it’s heirs will receive £430,000.

Assuming if the will includes a charity gift of £20,000 for the Friends of the Cromford Canal. This value must be greater than 10% of the taxable balance.

No tax is paid on the nil-rate band or the charity legacy, leaving a taxable balance of £155,000: this is taxed at 36% – £55,800 – leaving £424,200 for it’s heirs. In other words the £20,000 gift to charity has cost the heirs £5,800.

For more information see here.

How to leave a gift to support the Friends of the Cromford Canal

Friends of the Cromford Canal is a registered charity (No. 1164608) by the Charity Commission for England and Wales.

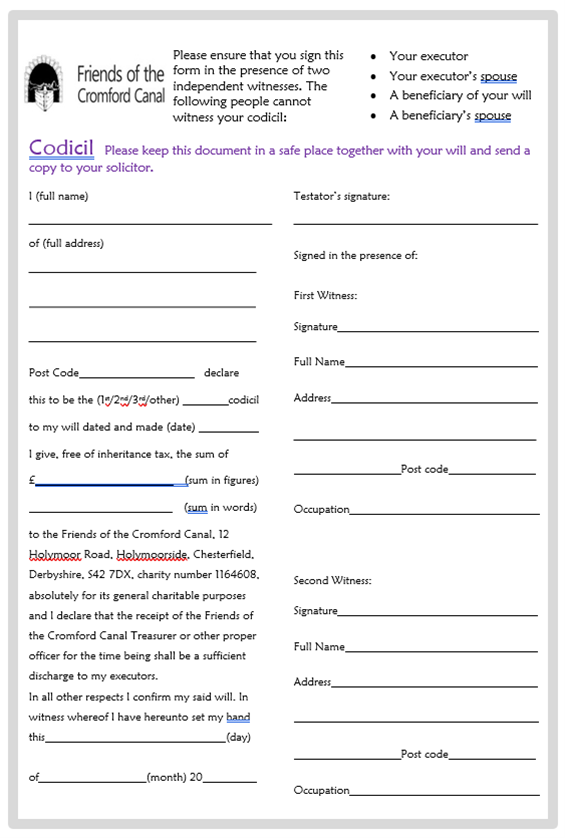

A simple gift can be left by including in your Will the sentence “I bequeath to Friends of the Cromford Canal of 12 Holymoor Road, Holymoorside, Chesterfield, Derbyshire, S42 7DX, Registered Charity No. 1164608 the sum of £… for its general purposes and I declare that the receipt of an authorised officer shall be full and sufficient discharge to my executor.”

If you would prefer to leave a residuary gift the wording would be:

“I bequeath {xx% of} my residuary estate to Friends of the Cromford Canal of 12 Holymoor Road, Holymoorside, Chesterfield, Derbyshire, S42 7DX, Registered Charity No. 1164608 for its general purposes and I declare that the receipt of an authorised officer shall be full and sufficient discharge to my executors.”

If you would like further information, please contact the Executive Secretary or the Treasurer.